Ah, the 1099 process … Something that should be so simple, yet proves to be a frustrating task every January. Over the last five years, we’ve worked and reworked our processes to make them as organized as possible. While we’re always on the lookout for ways to further streamline our system, we think we’ve got a good one and thought we’d take a blog opportunity to share it with you.

What is a 1099? Why does my company need to file them?

The 1099 form is an informational return filed by companies to report payments they’ve made to independent contractors and a few other special vendors. The IRS requires that these forms are filed annually.

→ Wait! Did the name of this form change? Why, yes it did. What was formerly called the 1099-Misc is now called the 1099-NEC (nonemployee compensation).

→ The 1099-Misc form is still hanging around. It’s used to report payments to specific types of vendors as well as interest payments.

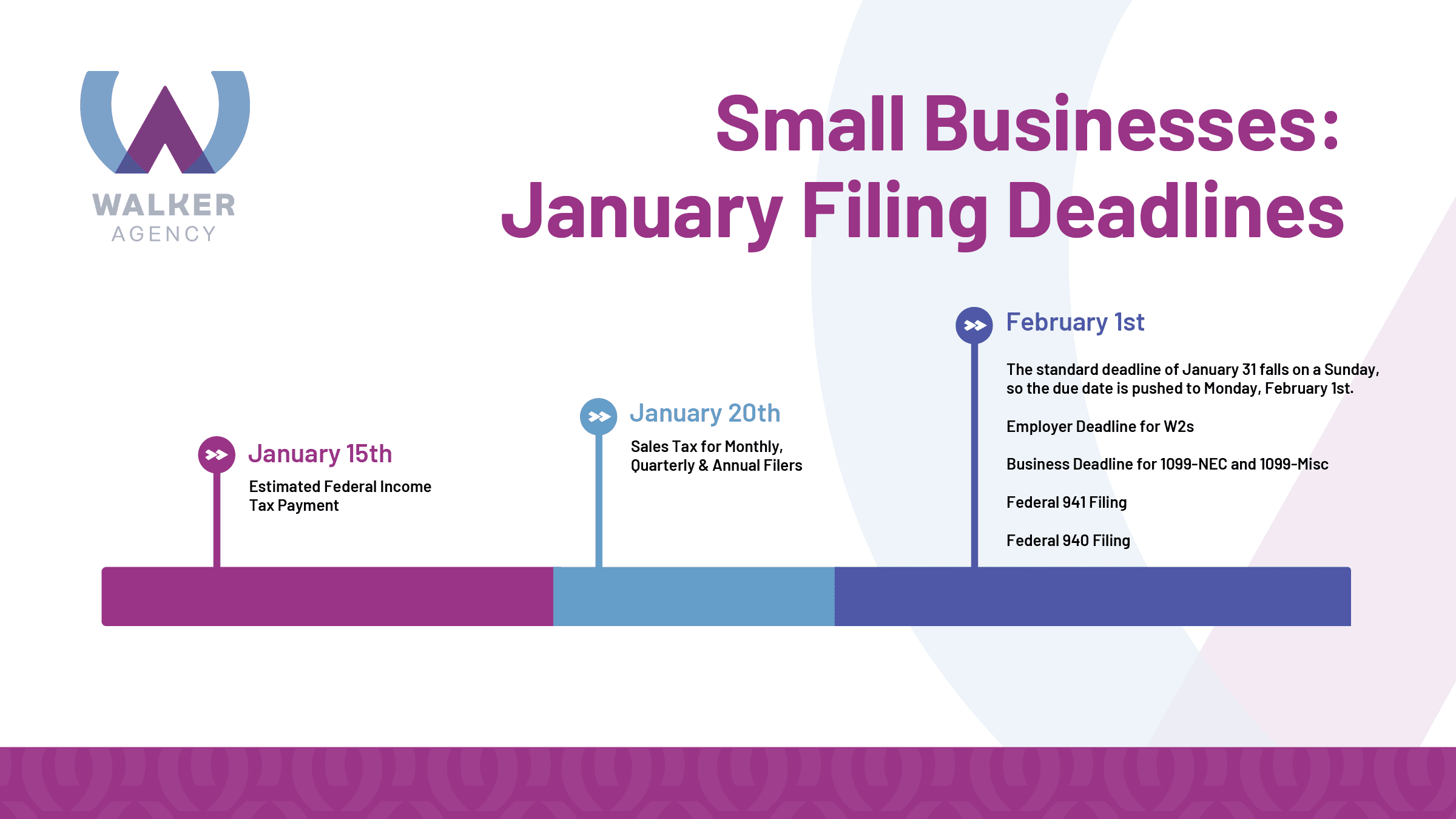

When do I need to file them?

The 1099-Misc and 1099-NEC due by January 31st. A copy is sent to the IRS and to the recipient. (Since January 31st is on a Sunday in 2021. The deadline is pushed to Monday, February 1st.)

Who do I file them for?

1099-NEC: Payments to individuals, estates, and partnerships.

1099-Misc: Payments to specific types of vendors such as attorneys and landlords.

→ 1099s are filed for services rendered, not for product purchases. Filings are required if total cash payments (cash, check, debit card, wire transfer, ACH payment) are $600 or more in a calendar year. If you make payments via credit card, those amounts are not reported on a 1099.

Pro-Tips:

- January is a crazy month and you don’t need the added stress of chasing down W9s from vendors. You’ll have an exponentially higher response rate if you require a W9 before paying a vendor for the first time. We have a standard email that states, “We are setting you up in our accounts payable system as a new vendor and require a W9 before issuing payment for your recent invoice. Please return a signed copy of your W9 so that we’re able to process your payment.”

- Start early! Make it part of your monthly closing processes to check for new vendors to make sure you’ve got a W9 on file.

- Automate your processes. There are a multitude of apps that will help you manage your filings and most will even take care of mailing copies to the recipients.

→ We’re partial to the 1099 module within QuickBooks Online. If we can’t file there, one of our favorite apps is efile4biz.com

- Save copies. Inevitably, you’ll receive messages from vendors who are preparing their tax returns and looking for copies of their 1099s. Be sure to encrypt files before emailing them to recipients.

For more helpful tips like this, follow us on social media.

Instagram: @wa1keragency

Facebook: https://www.facebook.com/wa1keragency