We recognize the IRS doesn’t exactly make it easy to figure out most things related to taxes. With that in mind, here’s a quick rundown on what you need to know for filing.

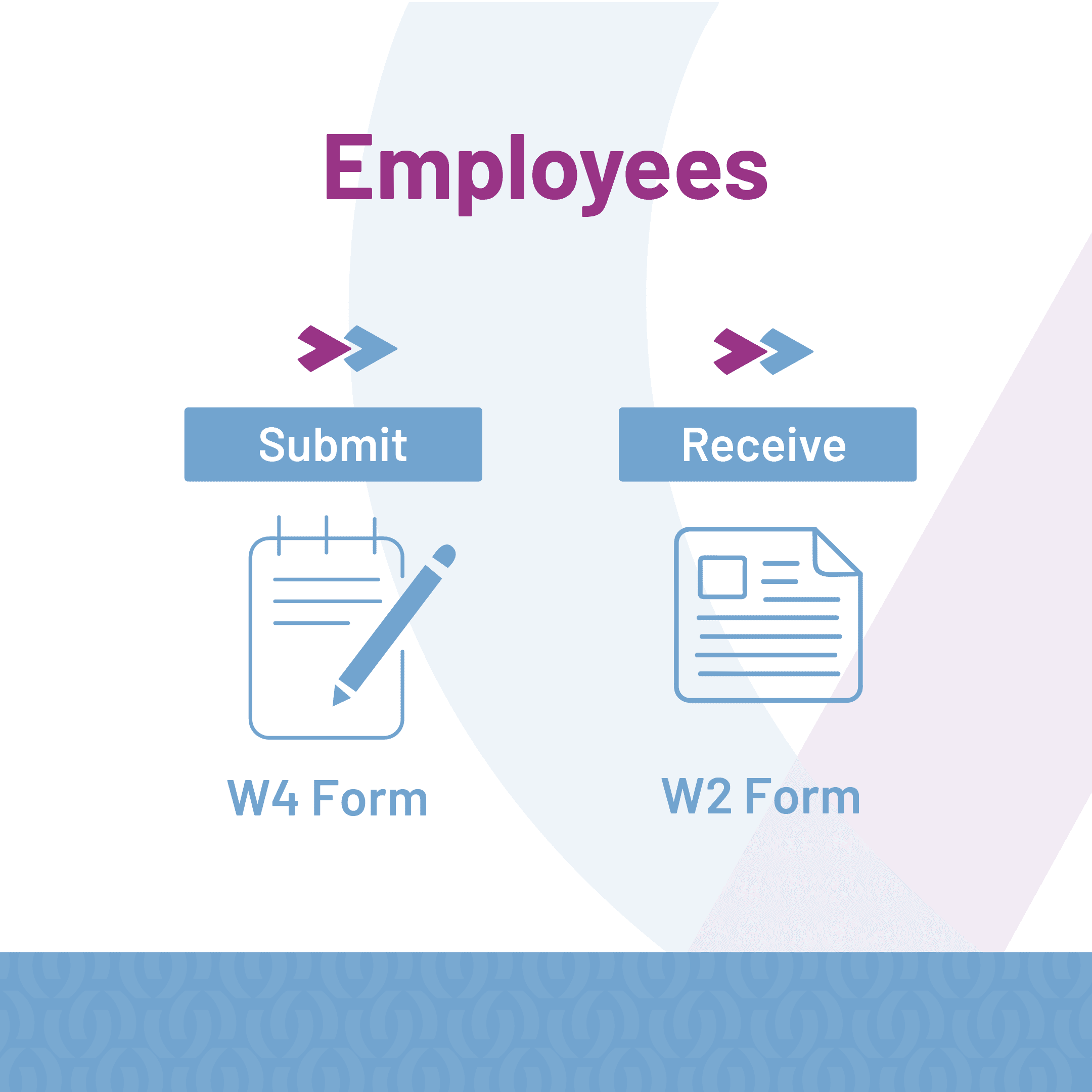

W2s and W4s

Employees fill out a W4 to tell their employer how much to withhold from their paycheck for personal taxes. By January 31st, the employer submits a W2 to the IRS to report total earnings and withholdings. They give the employee a copy so they can prepare their personal tax return.

Pro-Tip: As employees, our earnings are most likely going to vary from year to year. Tax filing statuses may change, too.

Make it a habit of filling out a new W4 at the beginning of each year and submitting it to your employer to make sure you’re withholding enough for personal taxes.

Modern payroll systems have “self-help” centers where you can login and change this information on your employee profile.

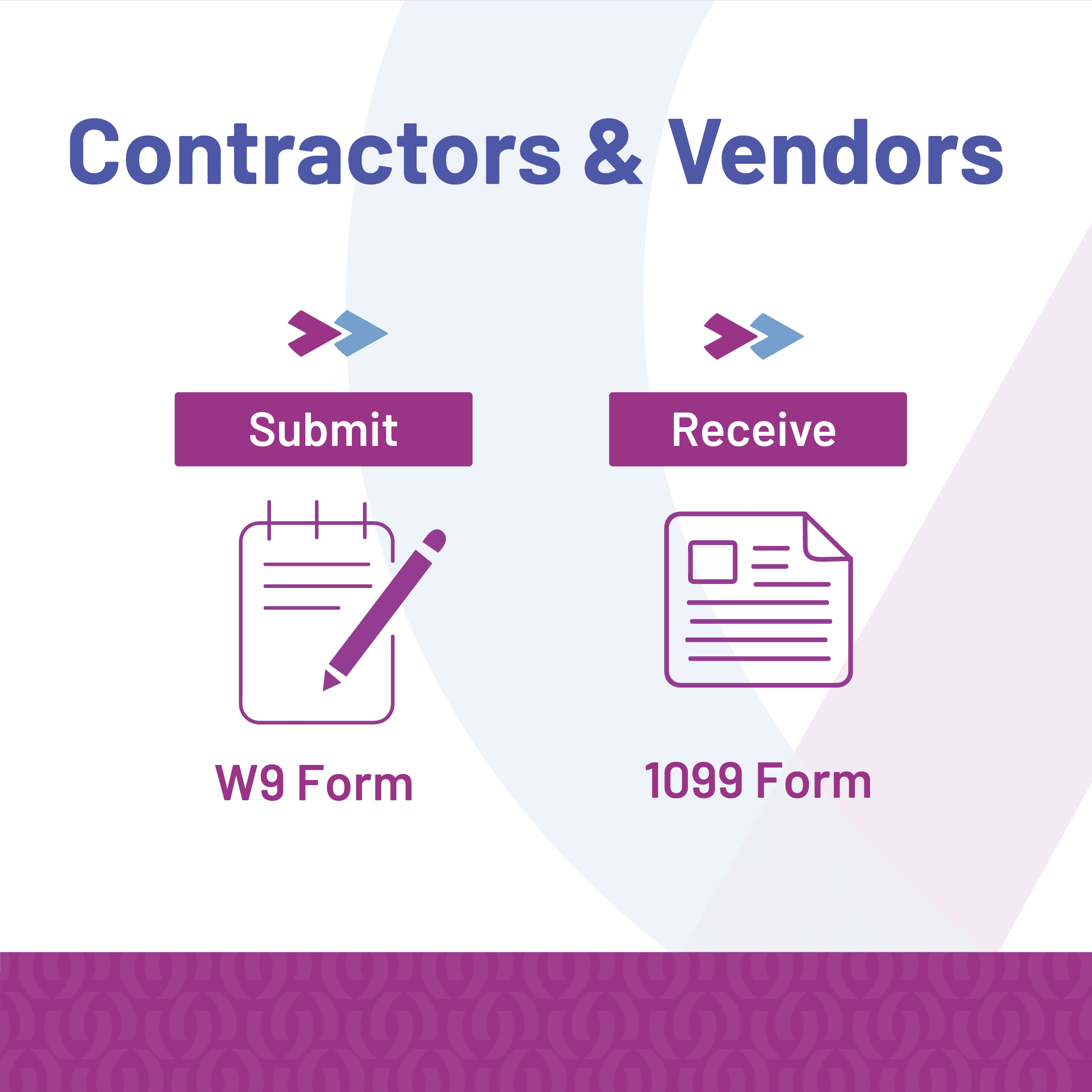

W9s and 1099s

Vendors and contractors give a W9 to each company that purchases their services. The form reports the tax filing status of the vendor/contractor and determines if a 1099 is necessary.

Form 1099 filings are filed with the IRS by January 31st and report the total amount paid for a vendor’s/contractor’s services in the previous year. The vendor/contractor will also receive a copy to use as support for their business tax return.

Pro-Tip: This one is for the bookkeepers and staff accountants. January is a crazy month and you don’t need the added stress of chasing down W9s from vendors.

You’ll have an exponentially higher response rate if you require a W9 before paying a vendor for the first time.

We have a standard email that states, “We are setting you up in our accounts payable system as a new vendor and require a W9 before issuing payment for your recent invoice. Please return a signed copy of your W9 so that we’re able to process your payment.”

To learn more about the types of 1099s and important changes for the 2020 filing year, read this blog.