What does a controller do for my tech startup?

Accounting, BookkeepingIn the early stages of your startup, hiring an internal accounting team is not your highest priority. When it’s just you, other founders, and a few vendors an outsourced bookkeeper will help ensure you remain tax

What does a controller do for my tech startup? Read More »

Advance Child Tax Credit: Should You Opt-Out?

Individual Tax Resources, Tax Tips, Tax UpdatesThe American Rescue Plan Act (ARPA) included a provision that allows for the IRS to begin making advanced payments of the Child Tax Credit next month. This credit, up to $3,600 per child under the

Advance Child Tax Credit: Should You Opt-Out? Read More »

Do I need to hire an accountant for my tech startup or is outsourcing a better option?

Accounting, BookkeepingIn all our experience working with startup founders, we know one thing for sure. You move fast, and you want your back office to move at the same speed you do. Because of the world

Do I need to hire an accountant for my tech startup or is outsourcing a better option? Read More »

The American Rescue Plan Act of 2021 – Individual Provisions

Individual Tax Resources, Tax UpdatesBelow we have assembled a brief summary of some of the individual taxpayer provisions of the American Rescue Plan Act of 2021 (ARPA), passed on March 11, 2021. A Third Round of Stimulus Recovery rebate

The American Rescue Plan Act of 2021 – Individual Provisions Read More »

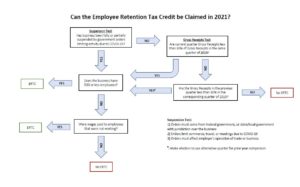

The American Rescue Act of 2021 – Business Provisions

Business Resources, Tax UpdatesBelow we have assembled a brief summary of some of the business taxpayer provisions of the American Rescue Plan Act of 2021 (ARPA), passed on March 11, 2021. Extension of the paid sick and expanded

The American Rescue Act of 2021 – Business Provisions Read More »

ARPA’S Enhancements to the Premium Tax Credit

Individual Tax Resources, Tax UpdatesThe premium tax credit (PTC) is a refundable tax credit that assists individuals and families in paying for health insurance obtained through a Marketplace (Healthcare.gov) and was established under the Affordable Care Act (ACA). Recent

ARPA’S Enhancements to the Premium Tax Credit Read More »

What’s the difference between a W2 and a 1099?

TaxesWe recognize the IRS doesn’t exactly make it easy to figure out most things related to taxes. With that in mind, here’s a quick rundown on what you need to know for filing. W2s and

What’s the difference between a W2 and a 1099? Read More »

Change in Deductibility of Business Meals

Business Resources, Tax Tips, Tax UpdatesBy now, you’ve probably heard that the recent stimulus legislation included a provision that removes the 50% limit on deducting business meals provided by restaurants in 2021 and 2022 and makes those meals fully deductible.

Change in Deductibility of Business Meals Read More »

What do I need to know about 1099s?

TaxesAh, the 1099 process … Something that should be so simple, yet proves to be a frustrating task every January. Over the last five years, we’ve worked and reworked our processes to make them as

What do I need to know about 1099s? Read More »

Consolidated Appropriations Act 2021 – Business Provisions

Business Resources, Tax UpdatesOn Sunday, December 27, 2020, the President signed into law one of the longest bills in US history. This bill, the Consolidated Appropriations Act 2021, is a sprawling 5,593 pages and contains a $900 billion

Consolidated Appropriations Act 2021 – Business Provisions Read More »