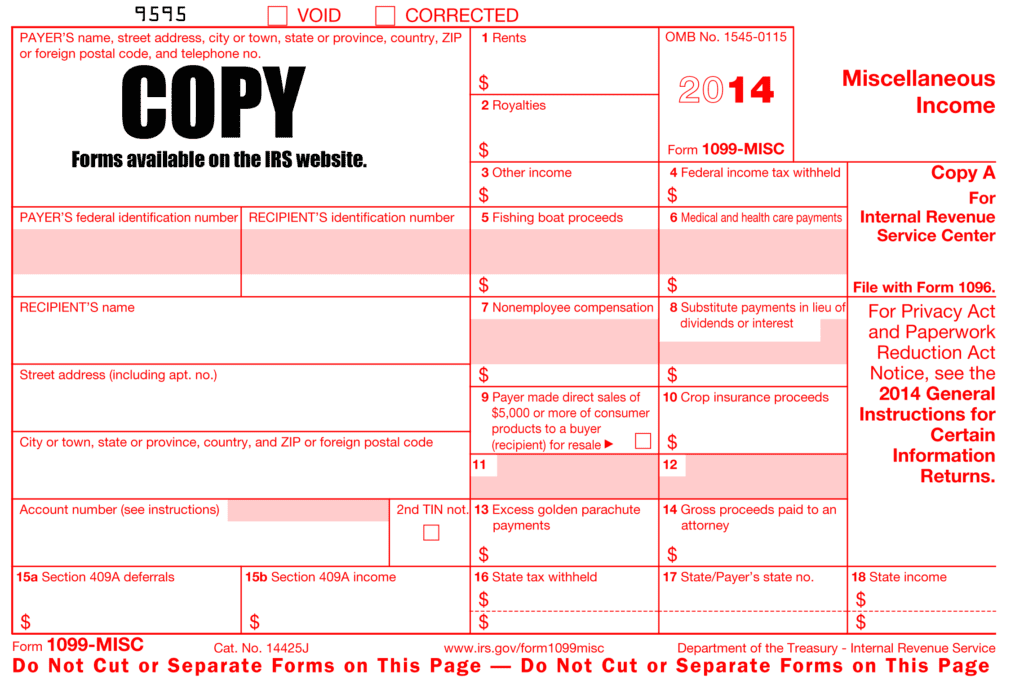

Almost halfway through January, the Form 1099-MISC deadline is quickly approaching. Copies of this form are due to the recipient at the end of January (February 2, 2015 for 2014 Forms, since January 31, 2015 is a Saturday) and due to the IRS at the end of February (March 2, 2015, since February 28, 2015 is a Saturday). Penalties for failing to file range from $30-$100 PER recipient.

Think you might be required to file? Visit my blog on who is require to file and find out!

For help filing these informational returns, contact Paul@LaunchConsultingInc.com

For full instructions, visit the IRS website using the link provided below:

http://www.irs.gov/pub/irs-prior/i1099msc–2014.pdf