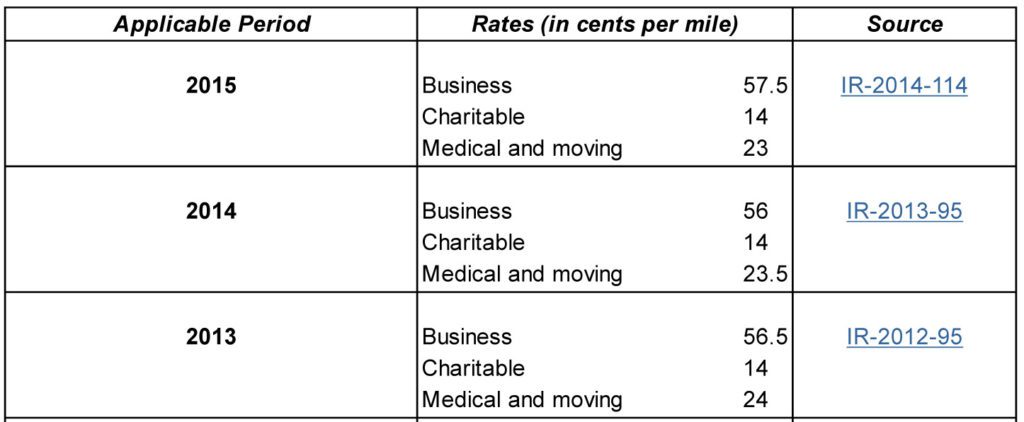

Back in December, the IRS issued the optional standard mileage rate for business, medical, moving, and charitable deductible costs.

Taxpayers have the option to use this rate as an alternative to the actual costs of operating an automobile.

Surprisingly, with the fall of oil prices, the rate for 2015 increased to 57.5 cents/mile, up 1.5 cents from the 2014 rate of 56 cents/mile. This rate includes all the variable costs of operating a vehicle (depreciation, insurance, oil, gas, tires, maintenance, and repairs).

As a reminder, once you being using actual costs for a vehicle, including actual gas expenses, depreciation, and insurance, you cannot switch to the standard mileage method.

For more information on taking advantage of this deduction, contact Paul@LaunchConsultingInc.com or visit the IRS website.