This Giving Tuesday, remember that donations to eligible organizations, cash or non-cash, are tax deductible and may reduce your tax liability come spring filing season.

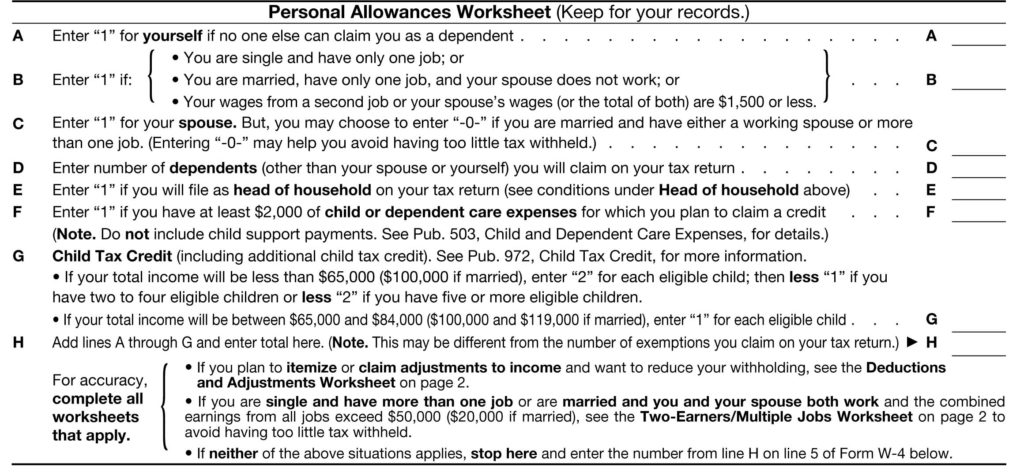

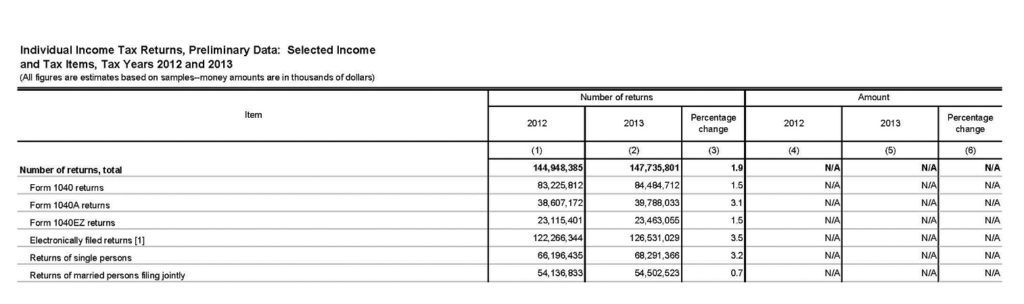

Are you eligible to claim charitable donations on your taxes? Only taxpayers who itemize using Form 1040, Schedule A can claim deductions for charitable contributions. You will most likely be a Schedule A filer if you pay for items such as mortgage interest, property taxes, state & local taxes, and charitable contributions that in total, exceed the current year standard deduction. If your itemized deductions exceed this standard deduction for the tax year, you will likely receive a benefit from charitable contributions.

For example, in 2016 the standard deduction for married filing joint taxpayers is $12,600. If the total of your mortgage interest, property taxes, and charitable contributions is in excess of the standard deduction ($12,600), you are an itemized taxpayer.

Is the organization your are contributing to an eligible entity? You can check for eligible entities on the IRS website using their “Select Check” tool. Note that newer organizations may not be listed on the IRS website yet and churches, synagogues, temples, mosques, and government agencies are eligible to receive deductible donations even if they are not listed in the IRS database.

Lastly, be sure to document your contributions with bank statements or canceled checks. If you contribution is greater than $250, ask the receiving organization for a written statement or letter acknowledging your contribution.