These days, a cell phone is no longer just a personal device; it’s a workplace must-have. With cloud-based tech advancing rapidly, features like email, remote payment processing, document access, project management apps, work calendars, and client calls are all conveniently synced to our personal devices. While there are no federal laws requiring a company to provide cell phone reimbursements, a handful of states have passed labor laws requiring employers to reimburse employees for work related use of personal cell phones.

Note: At the end of this blog you will find links to our free resources, two draft cell phone policies you can personalize for your business.

Corporate Owned, Personally Enabled (COPE) vs Bring Your Own Device (BYOD)

First off, you’ll need to decide between a corporate owned policy or implementing BYOD. COPE means the business fully owns the device and it’s solely used for the purpose of business. The cost of the device is handled by the company and is treated as a business expense. There’s no expense reimbursement process because the employee isn’t spending any of their own money.

However, following the uptick in remote-working in recent years, BYOD is fast becoming the choice with employers. Choosing to pay part of the employee’s bill (either through an expense reimbursement or a monthly stipend) can be much less costly in comparison to footing the whole bill with the COPE option. Furthermore, there’s a growing trend of employees incorporating their own personal device into their workflow even if they have a company cell phone. Data suggests the vast majority of employees prefer to use their own phone, even with work calls. People don’t want to have to keep up with two devices and two numbers, so they will often just use their personal phone thus negating the point of COPE (at the expense of the business).

How do I pay for the use of my employee’s cell phone during working hours?

If you choose to go with a BYOD plan, there are two options for the cell phone policy according to IRS rules:

An “Accountable Plan”

With this plan, an employee submits receipts through the company’s expense report system and receives reimbursement. The company elects to reimburse the employee all or a portion of the monthly expense. The reimbursement should not exceed the total expense and is not considered taxable income to the employee.

A “Non-Accountable Plan”

Companies may elect to provide employees with a stipend to cover the business use of a personal phone. Receipts are not needed to support the stipend and it should be processed as part of payroll. It’s important to know the stipend is treated as taxable income to the employee.

What does a cell phone policy look like?

Creating a cell phone policy is pretty straight forward. Here’s some guidance on what your policy should include:

Corporate Ownership

With a COPE plan, the company owns the cell phone and its data, so a simple document outlining the company’s expectations for phone usage and instructions on returning the device upon separation from the company is sufficient.

Employee Ownership

BYOD: Accountable Plan **

This type of policy should include the following components:

- The specific amount you will reimburse employees, per month

- The type of proof you will accept for reimbursement, i.e. a receipt or a copy of the monthly bill

- How often you will reimburse and deadlines for turning in receipts

- The IRS requires a use for business is proven by the supporting document

- It’s important you stipulate the company will not pay an amount that’s greater than the support

BYOD: Non-Accountable Plan **

Be specific about the following in your policy:

- The amount of of the monthly stipend an employee can expect, outlining it will be included with payroll

- It’s important to make it very clear the stipend is considered taxable income for the employee

** On average, we’ve seen our clients set a reimbursement or stipend amount of $50-$75 per month.

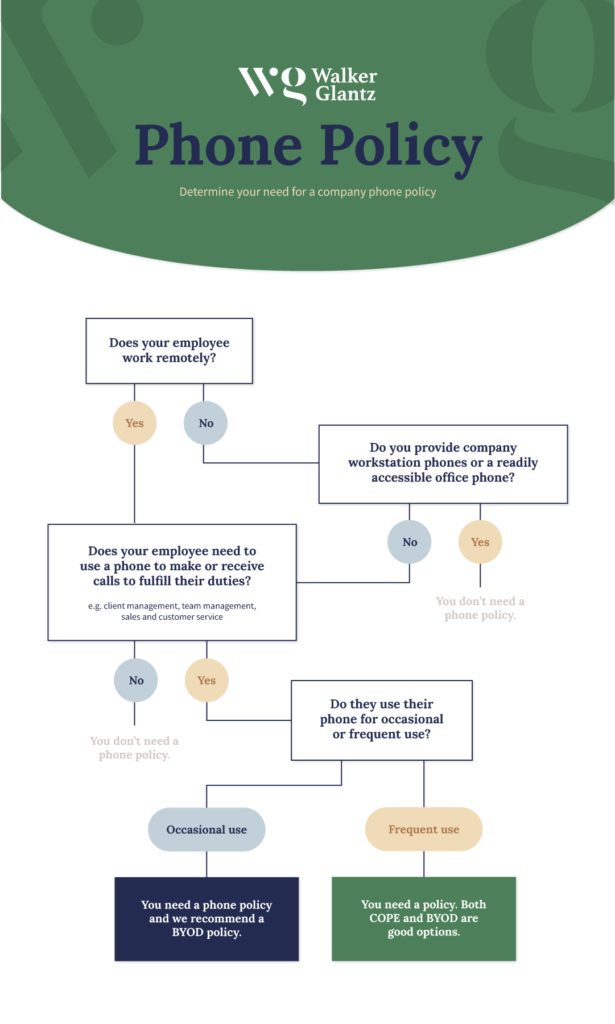

Use this diagram to decide if your business needs a phone policy. We suggest you refer to it for each employee as use of phones can vary per work position; it’s rarely “one size fits all.”

This is just a guide; we recommend checking your decision with an expert who understands your business. Your accountant is a good person to consult! And remember, if you opt for the BYOD policy, you’ll still need to decide whether you would like to reimburse your employees through an accountable or non-accountable plan.

This is just a guide; we recommend checking your decision with an expert who understands your business. Your accountant is a good person to consult! And remember, if you opt for the BYOD policy, you’ll still need to decide whether you would like to reimburse your employees through an accountable or non-accountable plan.

When do I need to put a cell phone policy in place?

If you don’t have a COPE plan in place, chances are employees are already using their personal devices for business. Considering a cell phone reimbursement plan? Download our free policy guidelines. The COPE policy is here and our free BYOD policy is here (accountable and non-accountable) These are guides – be sure to personalize them to fit your business.

If you have any further questions on how to get your policy up and running, including questions about the tax implications, get in touch with us here.