As the 2016 tax year winds down, there is no better time than now to get your finances in order. Let’s face it, the last thing you want to think about during the holiday season is taxes. I compiled a list of the deadlines to follow after year-end. Please note that legislation during the year changed the due dates for many common forms. Below is a summary:

Individual Due Dates:

- Individual Form 1040 – April 15th (no change)

- FinCEN Form 114 (FBAR) – April 15th (previously due June 30th)

Business Due Dates:

- Partnership Form 1065 – March 15th (previously due April 15th)

- S-Corporation Form 1120S – March 15th (no change)

- C-Corporation Form 1120 (calendar year) – April 15th (previously March 15th)

- Forms W-2 – January 31 (previously February 28 & March 31 if electronically filed)

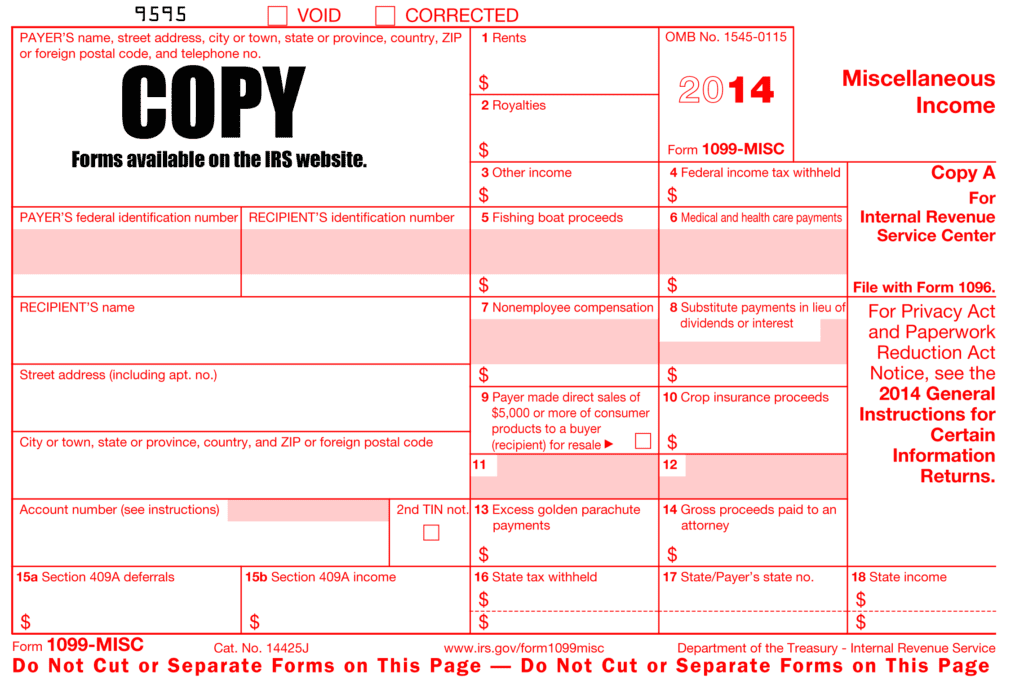

- Forms 1099-MISC – January 31* (previously February 28 & March 31 if electronically filed)

*This new due date is only for Forms 1099-MISC using Box 7 to report non-employee compensation.

For a complete list of all updated due dates, including Trust and Estate Forms 1041, and Form 990 for Exempt Organizations, the AICPA has compiled the changes into a PDF table.