As if you didn’t already have enough things to consider when planning your wedding, postponing or accelerating your wedding date could help you come out ahead from a federal tax standpoint.

While the lower brackets (10% and 15%) are exactly twice as large for married taxpayers filing jointly as the amounts for single taxpayers, the brackets above 15% actually have a marriage penalty built in.

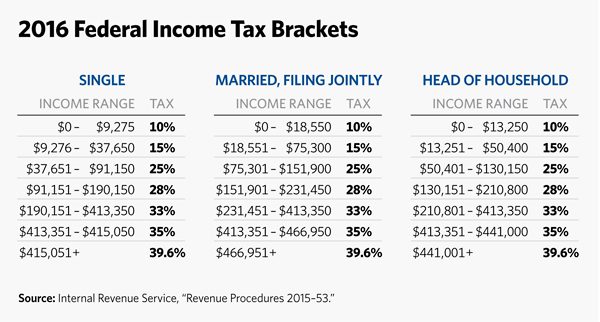

Take a look at the table below: For example, in 2016, unmarried taxpayers can each have $91,150 of taxable income and remain in the 25% bracket. If these same taxpayers were married, they would be in the 28% bracket with $182,300 ($91,150 x 2) of income. The 25% married filing joint bracket is not double the single 25% bracket (single 25% bracket: end at $91,150; married joint 25% bracket: ends at $151,900).

For example, in 2016, unmarried taxpayers can each have $91,150 of taxable income and remain in the 25% bracket. If these same taxpayers were married, they would be in the 28% bracket with $182,300 ($91,150 x 2) of income. The 25% married filing joint bracket is not double the single 25% bracket (single 25% bracket: end at $91,150; married joint 25% bracket: ends at $151,900).

As the marginal rates increase, there is even more of a penalty. Looking at the top brackets, a single taxpayer can make $415,050 before entering the 39.6% bracket, while a married couple would enter this bracket at $466,951. If two single taxpayers were earning $415,050, that would equate to $830,100, and both would still remain in the 35% bracket. If these same two taxpayers were married, $830,100 of income would push them well into the 39.6% bracket.

To illustrate, here is another example. Michael and Mary are planning to get married. Mary expects to have $300,000 of taxable income in 2016, and Michael expects to have $250,000. Their combined taxable income for 2016 will be $550,000. If they get married before 2017, and file a joint return for 2016, they will owe income taxes for 2016 of $163,466.30. If they delay their marriage until 2017, then for 2016, Mary will owe taxes of $82,529.25, and Michael will owe $66,029.25 for a combined tax of $148,558.50 . This will be $14,887.80 less than they would owe if they married in 2016 and filed a joint return for 2016.

It’s not all bad news, though. If only one of the prospective spouses has substantial income, marriage and the filing of a joint return will usually save taxes, thus resulting in a marriage bonus.