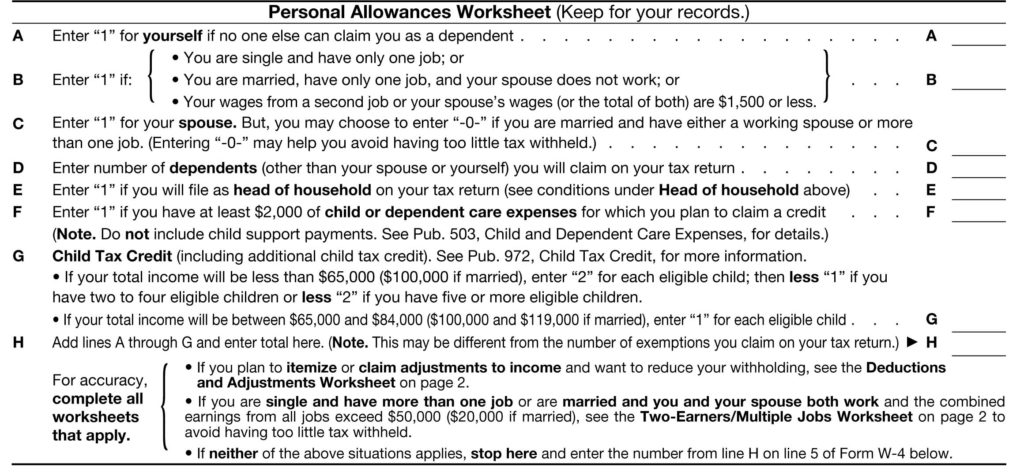

Two income families and those who work multiple jobs typically end up under-withheld. We recommend using the IRS Withholding Calculator to help navigate the complexities of multiple employer tax situations and to determine if the correct amount of tax for each employer is being withheld.

The passage of the Tax Cuts and Jobs Act (TCJA), which will affect 2018 tax returns that will be filed in early 2019, makes checking withholding amounts even more important. These tax law changes include:

- Increased standard deduction

- Eliminated personal exemptions

- Increased Child Tax Credit

- Limited or discontinued certain deductions

- Changed the tax rates and brackets

Individuals with more complex tax profiles, such as two incomes or multiple jobs, may be more vulnerable to being under-withheld or over-withheld following these major law changes. We recommend performing check on your withholding as early as possible, as doing so gives more time for withholding to take place evenly throughout the year. Waiting means you could end up with a hefty tax bill come filing season.

The IRS calculator will recommend how to complete a new Form W-4 for any or all of your employers, if needed. Please contact us if you need assistance with a check up.