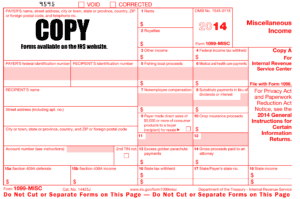

Due Date for Forms 1099 Quickly Approaching

Business Resources, Tax DeadlinesForm 1099-MISC along with many other informational returns are due to recipients at the end of this month. Last year, I gave a brief outline of who may be be required to file. Penalties for […]

Due Date for Forms 1099 Quickly Approaching Read More »