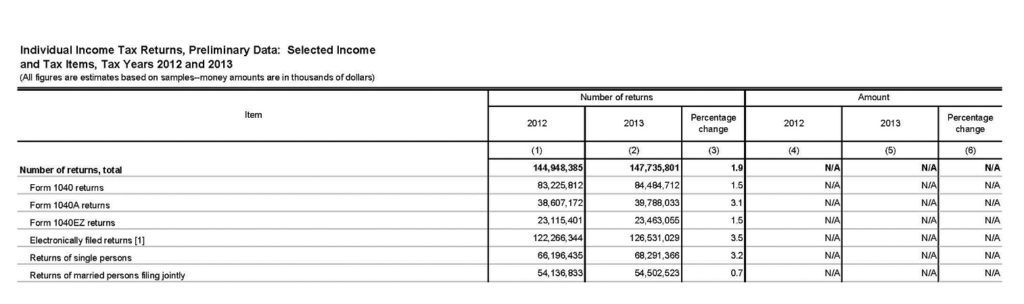

Last week, the IRS released the Spring 2015 Statistics of Income Bulletin. The bulletin includes preliminary numbers from the 2013 tax year. Some of the more interesting data points include the following:

- 147.7 Million tax returns were filed, 1.9% more than the previous year.

- Although Adjusted Gross Income (AGI) and taxable income was only up 0.8% from 2012 to 2013, total income tax increased 3.6% and total tax liability increased 4.5%, mainly due to the increase in the marginal tax rates implemented in 2013.

- The Net Investment Income Tax (NII Tax – 3.8%), new for 2013, brought in $11.7 Billion from 3.1 million tax returns.

The complete bulletin can be found here.