Updated February 2025

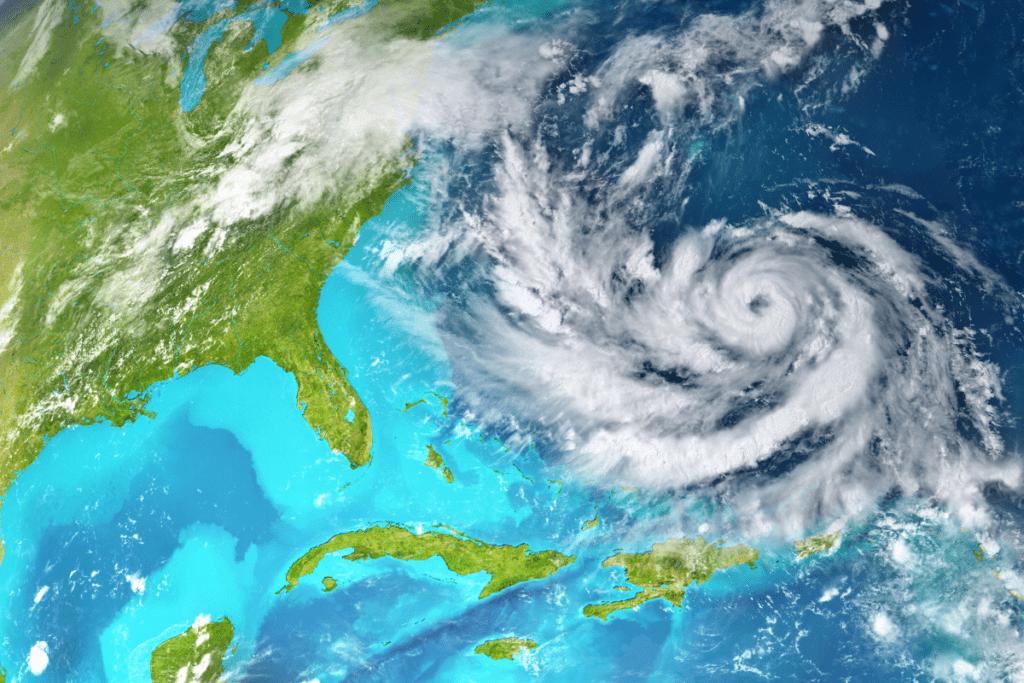

Hurricane Beryl has caused significant damage across several states, leaving many homeowners and businesses with substantial losses. If you were affected by this disaster, you might be eligible to claim a casualty loss on your tax return.

Walker Glantz PLLC, a Texas-based CPA firm, will guide you through what qualifies as a casualty loss, how to claim it, and why accurate records are essential for maximizing your potential tax benefits during this challenging time.

Understanding Casualty Losses

A casualty loss occurs when your personal property is damaged or destroyed by a sudden, unexpected, or unusual event. Events like Hurricane Beryl are considered casualties due to their unpredictable and destructive nature.

Here are some key points about casualty losses:

- Qualifying events: Casualty losses must be due to a sudden event like a hurricane, fire, flood, or theft. Normal wear and tear or gradual deterioration do not qualify

- Federal disaster area: Since Hurricane Beryl occurred in an area declared a federal disaster zone, losses incurred are eligible for specific tax relief benefits

- Unreimbursed losses: You can only deduct losses that are not covered by insurance or other reimbursements

Current Tax Law and Casualty Loss Deductions

Tax laws regarding casualty losses have evolved over time. Currently, there are important distinctions in how these losses are treated on tax returns that everyone affected by Hurricane Beryl should understand.

Under tax regulations effective through 2025, personal casualty losses are only deductible if they result from a federally declared disaster. Fortunately, Hurricane Beryl falls into this category, making affected taxpayers eligible for potential deductions.

For business property, casualty losses remain deductible regardless of whether they occur in a federally declared disaster area.

This distinction between personal and business property highlights why strategic tax planning with a knowledgeable financial partner becomes crucial after suffering hurricane damage. The rules differ substantially depending on the nature of your damaged property, and a tax professional can help you navigate these complexities.

Filing a Claim for Reimbursement

To deduct a casualty loss on your tax return, it’s crucial to file a timely claim with your insurance company. Here’s what you need to know:

Documentation: Keep copies of all correspondence with your insurance company, including claim forms, emails, letters, and responses. This documentation is essential if you need to substantiate your claim during an audit. Even if your policy does not cover certain damages (e.g., flooding), you must file a claim and have documented proof of denial.

Partial Payments: If your insurance company provides a partial reimbursement, make sure to document the amounts received and any remaining unreimbursed losses. This ensures that you accurately report the deductible portion on your tax return.

Calculating Your Loss

Determining the amount of your casualty loss can be complex, but we have some tips on how to approach it.

Figure the amount of your loss using the following steps:

- Determine your adjusted basis in the property before the casualty or theft

- Determine the decrease in fair market value (FMV) of the property as a result of the casualty or theft

- From the smaller of the amounts you determined above, subtract any insurance or other reimbursement you received or expect to receive

Understanding Adjusted Basis and Fair Market Value

Your adjusted basis is typically what you paid for the property, plus improvements and minus depreciation. For inherited property, the basis is usually the fair market value at the time of inheritance.

The decrease in fair market value (FMV) is the difference between the property’s value immediately before and after the casualty. This often requires professional appraisals, particularly for significant damage or high-value items.

Many property owners make the mistake of using replacement cost rather than FMV decrease, which can lead to incorrect deduction amounts. A strategic financial advisor can help ensure you’re using the correct valuation methods for your tax filings.

Special Considerations and Timing

When navigating casualty losses, smart tax planning can significantly impact your financial recovery.

The timing and approach you take with these deductions can create meaningful differences in your tax outcome:

- Itemizing Deductions: Casualty losses typically require itemizing deductions. For tax years 2018 through 2025, casualty or theft losses of personal-use property are only deductible if the loss is attributable to a federally declared disaster

- Year of Deduction: Generally, you deduct casualty losses from a federally declared disaster area in the year they occur. For federally declared disasters like Hurricane Beryl, you have the option to report on the tax year immediately before the disaster year (e.g. if the loss occurred in 2024, you could report on your 2023 or 2024 filing)

- Net Operating Loss (NOL): If your casualty loss exceeds your income, it may create an NOL, which can be carried forward to offset income in future years

The Critical Importance of Timing Your Deduction

The option to claim losses in the prior tax year can provide immediate financial relief through a faster tax refund. This strategic decision requires careful analysis of your complete tax situation for both years.

For business owners, this timing decision becomes even more critical, as it can affect not only your personal taxes but your business’s cash flow and financial reporting. A strategic financial partner can model various scenarios to determine which approach maximizes your financial benefit.

Documentation—the Foundation of Successful Claims

Accurate record-keeping is very important when dealing with casualty losses. Thorough documentation of claims, denials, repairs, and valuations supports your tax deduction claim and aids in audits.

Essential documentation includes:

- Before and after photos of damaged property

- Repair estimates and invoices from contractors

- Property appraisals showing pre-disaster values

- Insurance claim forms and correspondence

- Proof of ownership for damaged assets

Most people underestimate the level of documentation required, particularly for substantial losses.

Having a systematic approach to organizing these records can save significant time and stress during an already difficult period of time.

Special Considerations for Business Owners

For business owners, hurricane losses create additional layers of complexity. Beyond the direct property damage, you may face:

- Losses from interruption of business

- Employee-related challenges

- Supply chain disruptions

- Cash flow implications

These secondary effects can often have greater financial impact than the direct property damage. A strategic financial advisor can help you navigate both the immediate tax implications and the longer-term financial recovery strategy.

Business casualty losses follow different rules than personal losses, often allowing for more favorable tax treatment. Understanding these distinctions can significantly impact your business’s financial recovery.

The $100 and 10% Rules: Important Limitations

When calculating personal casualty losses, two important limitations apply:

- You must reduce each casualty loss by $100

- You must further reduce the total of all casualty losses by 10% of your adjusted gross income

These limitations don’t apply to business or income-producing property. This creates another strategic consideration for business owners who may have suffered damage to both personal and business assets.

Looking Beyond the Immediate Tax Filing

While tax deductions provide some financial relief, a comprehensive recovery strategy should consider several key areas.

Insurance policy reviews and potential updates are essential to ensure adequate coverage for future events. Emergency fund rebuilding helps restore your financial safety net that may have been depleted. Disaster preparedness planning can mitigate damages from future events. Long-term financial protection strategies safeguard your assets against various risks beyond natural disasters.

As your strategic financial partner, Walker Glantz can help develop this broader recovery framework, ensuring that your financial foundation is stronger and more resilient against future disasters.

Getting Professional Help

Navigating casualty loss deductions can be challenging, especially during the stressful aftermath of a hurricane.

Working with a qualified tax professional provides several advantages:

- Maximizing deductions through proper documentation and calculation

- Avoiding audit triggers by ensuring compliance with IRS regulations

- Strategic timing of when to claim the loss for optimal benefit

- Proper categorization of business versus personal property losses

- Integrating the loss into your broader financial strategy

Hurricane aftermaths across the country have left many dealing with significant property losses. Understanding the rules surrounding casualty loss deductions can help ease the financial burden.

At Walker Glantz, we’re committed to helping you navigate these challenges and ensuring you receive all available tax benefits.

We’re here to serve as your strategic financial partner, not just during tax season but throughout the recovery process. Our expertise in disaster-related tax matters can help transform a devastating loss into an opportunity to rebuild your financial foundation with greater strength and resilience.

Contact us today to schedule a strategic consultation about your hurricane-related losses and financial recovery plan.