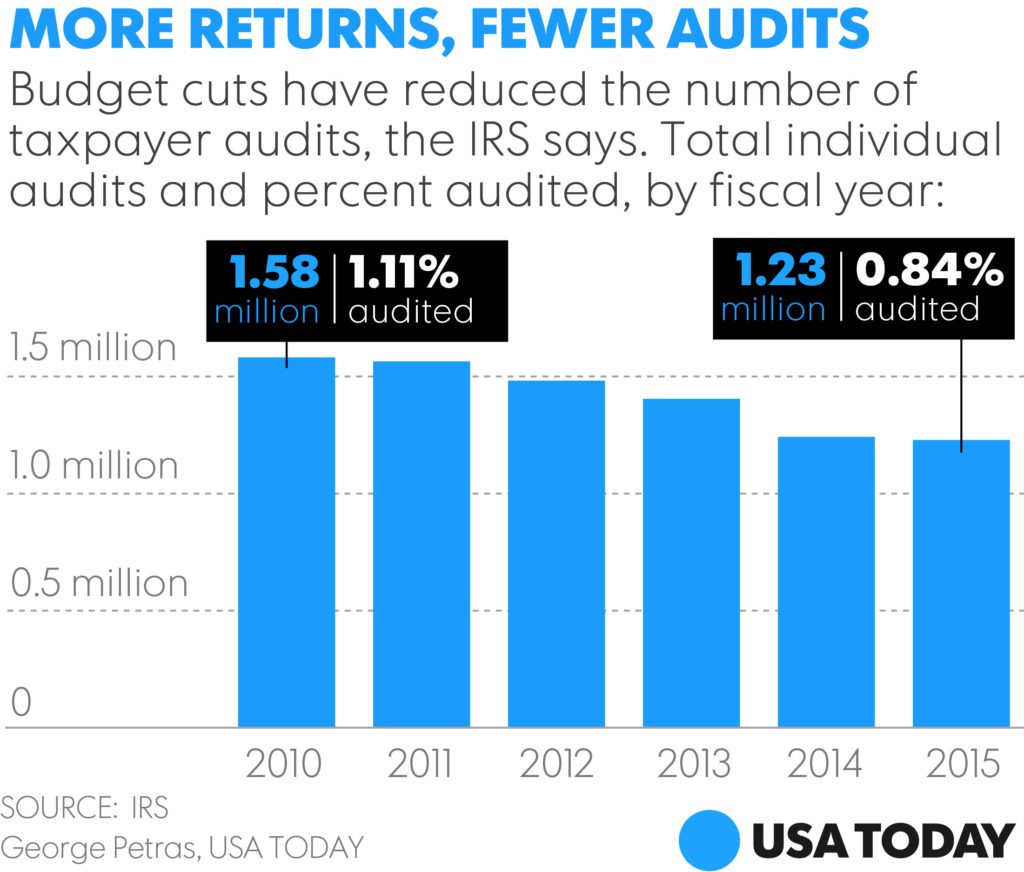

A recent report shows IRS individual audit rates at the lowest level since 2004. In addition to cuts in IRS funding and staffing, the 8 million phone calls the IRS dropped, and the cyber theft of $39mm from fraudulently filed returns, audit rates have dropped to 0.84%. To put this in perspective, just over 8 returns for every 1,000 filed are examined by the IRS in person or via mail correspondence.

The drop in audit rates marked the third consecutive year with audit coverage below 1%. Things have not been looking good for the IRS post the Tea-Party Scandal. Revenue from audit collections have been a measly $7.32 billion so far this year, compared with the $14.7 billion average between 2005-2010.

Less head count in the office, fewer audits, and longer phone wait times put the voluntary compliance system at risk for tax cheats and fed up taxpayers.

The IRS is working diligently to correct the problems. We have already seen new processes for ramping up security and battling fraudulent returns.

For questions or more information on how this may impact you, or if you are in need of assistance with an IRS audit, contact Paul Glantz, CPA at paul@launchconsultinginc.com