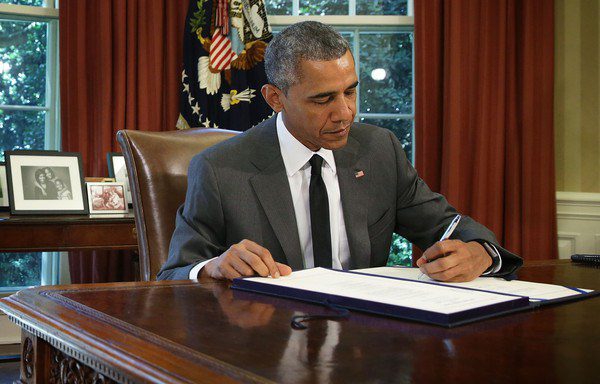

On the last day of July, Obama signed into law, H.R. 3236, the “Surface Transportation and Veterans Health Care Choice Improvement Act of 2015”. One of the provisions of this law included a change to the due dates of corporation and partnership tax returns.

Previously, C-Corporation and S-Corporation tax returns were required to be filed within two and a half months after the close of its tax year, or March 15 for calender year filers, and partnerships were required to file within three and a half months after the close of their tax year, or April 15, the same date that applies to individuals.

The Act moved the partnership deadline to March 15 (or two and a half months following the close of its fiscal year), and pushed the C-Corporation deadline back a month, to April 15 (or three and a half months after the close of its tax year). For most taxpayers, this law will be effective for the 2016 tax year, as it addresses tax years beginning after December 31, 2015.

For more information on H.R. 3236 or tax deadlines, contact Paul at paul@launchconsultinging.com